Town Clerk and Treasurer

Tax payments, vital records, certificates/licenses and voter resources

Town Clerk / Treasurer

(802) 773-2528

Fax (802) 773-7295

Office hours

Monday-Thursday: 8:00 AM to 4:30 PM

Friday: 8:00 AM to 2:00 PM

Rutland Town Municipal Office

181 Business Route 4

Center Rutland, VT 05736-0102

Four ways to pay your property tax bill

Online payment by Credit/Debit card or eCheck

Payment must be made by 11:59 pm on the tax bill due date (fees apply). Parcel ID and phone number are required. We will receive an email from our vendor site with a timestamp. Learn more about online payments by credit/debit card or eCheck.

ACH Direct Debit - Automatic payments

We now have the feature to set up your tax installments automatically. Print and fill out the form in the link below and your tax payments will be scheduled to automatically credit your account each due date of the tax year. This payment option will be reoccurring until you provide written notice of cancellation.

To Enroll You Must:

- Print off and fill out the Direct Debit form available here. Direct Debit Form

- Forms MUST be presented in person at Town Hall

- Bring a valid ID, a voided check or a completed savings account deposit slip.

Pay in person

Payment must be made at the counter by the close of office hours on tax bill due date. Credit Cards accepted (fees apply). Learn more about credit/debit payments.

Payment by mail

Envelopes must have an official USPS postmark for on or before the payment due date. Payments received after the due date, without an official postmark, are considered late.

IMPORTANT:

- A postmark is no longer guaranteed. To ensure an official USPS postmark, have your envelope hand stamped by the Postmaster.

- Using a bill pay service? Envelopes are not postmarked. If payment arrives after the due date, it is considered late.

Property tax resources

Records, licenses, and certificates

How do I obtain information on land records, such as:

- Deeds

- Mortgages

- Liens

- Surveys

- Other recordings

Vital Records / Certificates / Licenses

- Apply/get a copy of a Marriage / Civil Union license

- Get a copy of a Birth / Death certificates

- Dog license registration

Town and Cemetery Fund Records

Voter resources

Property Taxes

Property tax questions

The Rutland Town Treasurer is responsible for property tax invoicing and receipt of tax payments. If you have questions about your property tax bill, please contact the Town Treasurer phone at (802) 773-2528 or send an email.

How to pay your property tax bill

There are three ways to pay your Rutland Town property taxes:

Payment by mail

Envelopes must have an official USPS postmark for on or before the tax bill due date. Payments received after the due date, without an official postmark, are considered late.

IMPORTANT:

- A postmark is no longer guaranteed. To ensure an official USPS postmark, have your envelope hand stamped by the Postmaster.

- Using a bill pay service? Envelopes are not postmarked. If your payment arrives after the due date, it is considered late.

Pay in person

Payment must be made at the counter by the close of office hours on the tax bill due date. Stop by with your check payment or pay by credit or debit card. Credit/debit card payments incur a per transaction service fee of 2.65% or $3.00 minimum (charged by the card payment processing company for this service).

Pay online

Payment must be made by 11:59 pm on the tax bill due date (fees apply, see below). We will receive an email confirmation of payment from the online payment processing company with a timestamp.

For all online payments we require a valid Parcel ID number and phone number so we can ensure that your property tax payment is attributed to the correct parcel, and we can contact you if there are any concerns. For any questions, please contact the Town Treasurer by phone at (802) 773-2528 ext. 3201 or send an email.

By Credit Card

You can pay your Property Tax Payments from the comfort of your home or office by using our online payment service. A per transaction service fee of 2.65% or $3.00 minimum will be charged by the the online payment processing company for this service.

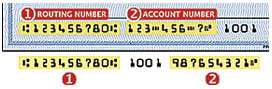

By Electronic Check

Rutland Town accepts electronic check payments using our online payment service. Payments will be charged to your checking or savings account at your bank. You will need your 9-digit routing number, as well as your account number from your personal checks (see image below). A per transaction service fee of $1.50 will be charged by the the online payment processing company for this service.

IMPORTANT: When the "Payment Options" selection appears, click on the “Switch to Pay with Check” link and then continue entering your information.

Property Tax Billing

When are property tax bills mailed and when are they due?

The property tax bills are mailed once a year in August. They are due September 10th, January 10th and May 10th.

Reminders are not mailed out.

Are prepayments for future tax years accepted?

No. Rutland Town does not accept prepayments for future tax years that have not been billed.

Delinquent Taxes

Taxes are delinquent 20 days after the final tax due date. The Delinquent Tax Collector will notify all delinquent tax payers regarding the amount of taxes owed as well as the penalty and interest charges due to the Town. For questions about delinquent taxes, contact the Delinquent Tax Collector at (802) 683-7920 or send an email

Obtain Records, Licenses, and Certificates

Land Records

The Town Clerk is responsible for the recording of land records including deeds, mortgages, liens, surveys as well as other recordings. For information on how to obtain land records, contact the Town Clerk by phone at (802) 773-2528 or send an email.

Land records are available online through the Land Records Portal.

A Cott Systems account will be required to search and obtain records online.

Marriage and Civil Union Licenses

The Town Clerk is also responsible for filing and indexing of all town vital records including marriages, civil unions, births and deaths. If you have questions, please contact the Town Clerk by phone at (802) 773-2528 or send an email.

How to apply for a marriage or civil union certificate

Marriage or civil union license applications typically require 24 hours' notice. Visit the Town Clerk's office for an application. Or save time and complete the Getting Married in Vermont form prior to visiting the office and bring it with you. Payment required.

How to get a copy of a marriage or civil union certificate

Copies of marriage certificates can be obtained at ANY town or city clerk's office in the state with a valid ID. You can also request a copy of a Marriage Certificate online.

Birth and Death Certificates

Copies of birth and death certificates can be obtained at ANY town or city clerk's office in the state with a valid ID. You can also request a copy of a Birth or death certificate online. If you have questions, please contact the Town Clerk by phone at (802) 773-2528 or send an email.

Voter Resources

The Town Clerk is responsible for administration of all Town election proceedings. If you have questions, please contact the Town Clerk by phone at (802) 773-2528 or send an email.

How do I register to vote?

In Vermont there is no deadline to register to vote. You are allowed to register to vote up to and including the day of the election. If you are registering to vote in Vermont for the first time, you must provide an acceptable form of ID, such as:

- Valid photo ID (driver’s license or passport)

- Current utility bill

- Current bank statement

- Another government document containing your residential address.

To register, visit the Town Clerk's office for an application or start by completing this form (be sure to bring an acceptable form of ID with you from the above list) or you may also register to vote online.

IMPORTANT: If you register to vote online the day before an election or on Election Day, your application may not be processed and your name may not appear on the checklist. In this instance, you may be asked to complete another application at the polls. To be sure your name appears on the checklist, please register by the Friday before the election.

When and where do elections take place?

Rutland Town residents vote at the Town Elementary School at 1612 Post Road and our Municipal Town Office at 181 Business Route 4 in Center Rutland.

Upcoming election information and news

Rules for Pets and Licensing

All dogs and wolf hybrids that are more than six months old need to be registered with the Town of Rutland on or before April 1 each year.